News

Jan Sell joins Baltasaar Advisory Board

Baltasaar is pleased to present its Advisory Board in the next few weeks. The Advisory Board is expanded throughout the upcoming weeks to include experts from selected business and science domains in order to underline our mission to democratize capital markets. We...

We invite you to Kyiv! Meet us at BlockchainUA, May 22nd, 2020!

Digital Financing for Companies BlockchainUA is one of the most prominent blockchain conferences in Eastern Europe. The conference is organized by our partner Distributed Lab und Pavel Kravchenko ausgerichtet. Distributed Lab contributed most of the source-code of the...

Jørgen Leschly Thorsted joins Baltasaar

Baltasaar welcomes a new partner: Jørgen L Thorsted leads the expansion into the Nordics as Partner Business Development (BERLIN und COPENHAGEN, 25.05.20) Jørgen Thorsted joins the Baltasaar team as Partner Business Development and is responsible for the expansion...

Baltasaar and CM-Equity AG establish strategic partnership

Baltasaar goes banking: we are now fully MiFID II-regulated and enable direct public placements for our security issuers (BERLIN and MUNICH, 04/23/20) CM-Equity, a leading financial services provider focused on placements and capital market services for institutional...

Blockzeug presents: Baltasaar | Funding-as-a-Service

Blockzeug proudly presents: Baltasaar – Funding-as-a-Service When we started Blockzeug, our vision was simple: driven by a groundbreaking technology, the blockchain, we wanted to help great projects and entrepreneurs to realize the full potential blockchain technology...

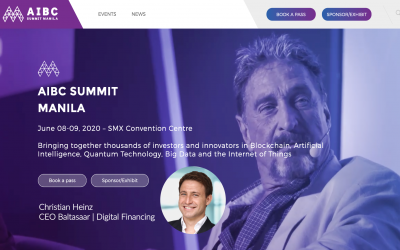

Meet Baltasaar at AIBC Summit Manila!

Come join us at AIBC Summit Manila! We are excited to announce that we will be attending AIBC Summit Manila. More than 10,000 delegates from all around the world will gather on June 8th and 9th in Manila’s SMX Convention Centre to discuss the future of Artificial...

How Investors gain access to institutional high-yield products.

Baltasaar enables institutions to reduce financing costs by up to 90% through blockchain-powered orchestration and automation of most processes that are traditionally expensive in capital markets. By saving these costs with fully digital investment products, the companies can provide investors with higher returns.

How Companies increase their placement reach with digital investment products.

Cut time-to-liquidity by up to 90% through a zero-error compliance process, product admin and workflow automation, and access to our marketplace for direct placement. The digital sales engine enables you to maximize CLTVs through touchpoint maximization and introduction of up-&cross selling potentials & loyalty programs.