Technology

Issue a Digital Product with a few clicks

As a company you get an end-to-end solution:

- We structure your financial instrument & originate your investment product

- We obtain «no action» regulatory pre-approval, create the security prospectus, administer the filing and manage the hearing procedure

- We digitally issue the product in primary markets, do the technical fulfillment and automate most of the admin work, such as KYC/AML and order & payment management

- All products can be traded in secondary markets through our built-in exchange service (OTC)

FMA-compliant Public Offering

Baltasaar automates the entire investment process of a public offering compliant with all regulations: Vehicle and product structuring, primary issuance, automated compliance, administration & distribution, and trading on a built-in secondary market.

You receive a FMA-approved prospectus, a fully digitized instrument and can, thus, passport the products and access EEA-wide distribution.

The most commonly digitized instruments from a regulatory standpoint of view are (i) subordinated debt, (ii) participation notes, and (iii) limited partner shares.

Cut Time-to-Liquidity with Direct Placement

Once the product is run through the regulatory process on our platform, the technical aspects are set up and you are ready for investment.

- Get the html-snippet and easily publish the product on your owned/earned/paid media outlets

- List the product on the marketplace to market to and onboard investors with the digital sales engine

- Integrate with affiliate networks and partner programs

- Handle the entire product lifecycle on the platform

- Increase the CLV by maximizing touch points, presenting OTOs, and introducing referrals, loyalty programs & up-/cross selling opportunities

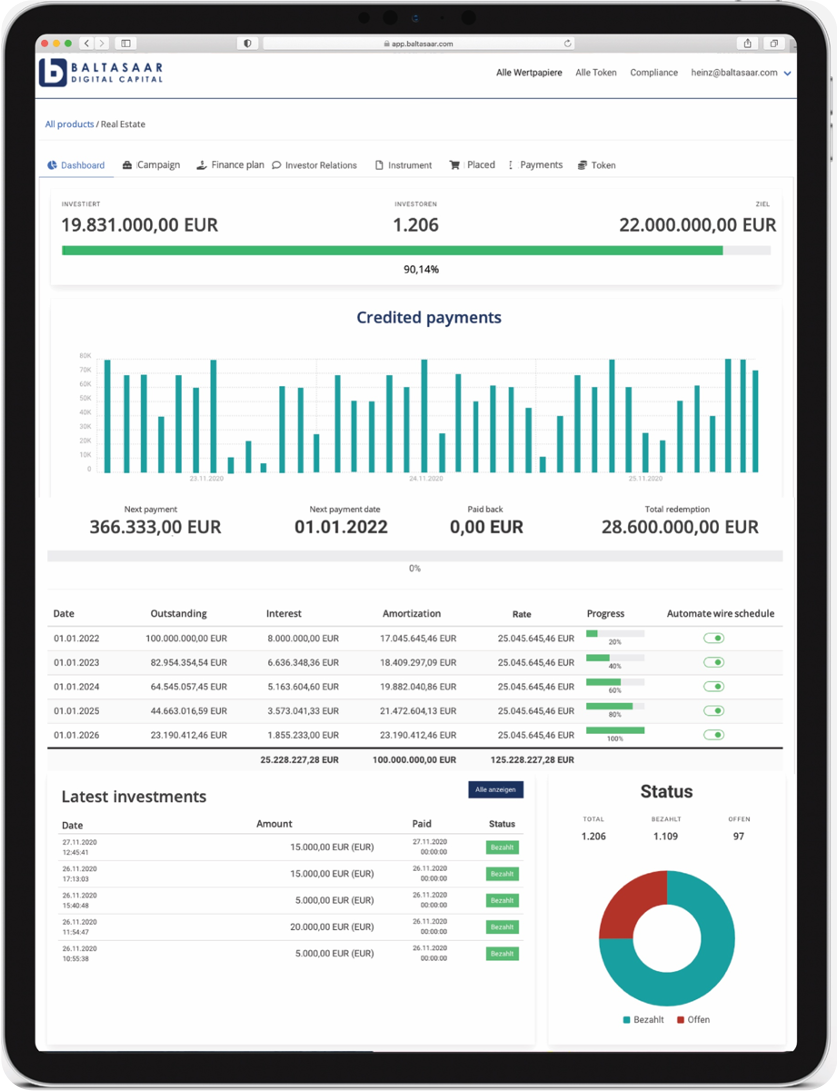

Admin and Workflow Automation

You can automate a large part of the product issuance and administration, KYC- & AML-compliant investor onboarding, and payment and redemption management & subscription, billing, and accounting workflow.

Baltasaar leads the investor through a simple, regulatory compliant onboarding process that enables investors to purchase the product legally-binding with just a few clicks. We do KYC through ID upload or integrated VideoIdent with our partner, we process all incoming payments automatically with HCBI/PSD2-integration, match and credit all payments with subscriptions and act as the transfer desk for the subscriber. Then, all paybacks can be automated with payment plans.

We enable an unrestricted, instant, and ultra-convenient capital market experience for all participants. Companies cut time-to-liquidity by up to 90%.

Digital Securities.

Easy to invest, simple to manage, fast to trade.

Baltasaar enables standardized, compliant, European-wide issuance & distribution of digital securities – at a fraction of the traditional cost.